As the cost of living crisis deepens, more and more families find themselves on the housing list. What can Tower Hamlets do? No extra costs and meet the housing targets? Read on.

Social Media Wars: Where are the new Council-owned housing in Tower Hamlets?

A brief examination of the social media landscape reveals an intense debate within the realm of local Tower Hamlets politics. Some may dismiss it as a minor controversy, akin to a storm in a teacup. The focal point of contention revolves around Mayor Lutfur Rahman’s commitment to delivering 4,000 homes during his tenure.

As I conveyed to a former colleague who once served as a councillor, the process of bringing a housing scheme to fruition typically spans 4 to 5 years. This encompasses stages such as planning, tendering, construction, and ultimately, the relocation of residents. These timelines can be further complicated by rising costs attributed to inflation and supply chain disruptions resulting from the lingering effects of the COVID-19 crisis.

Nevertheless, a fundamental question persists: In light of these challenges, how does Tower Hamlets intend to achieve its ambitious goal of providing 4,000 council-owned or social housing units?

In every crisis, there is an opportunity: Arbitraging for Council Owned Homes?

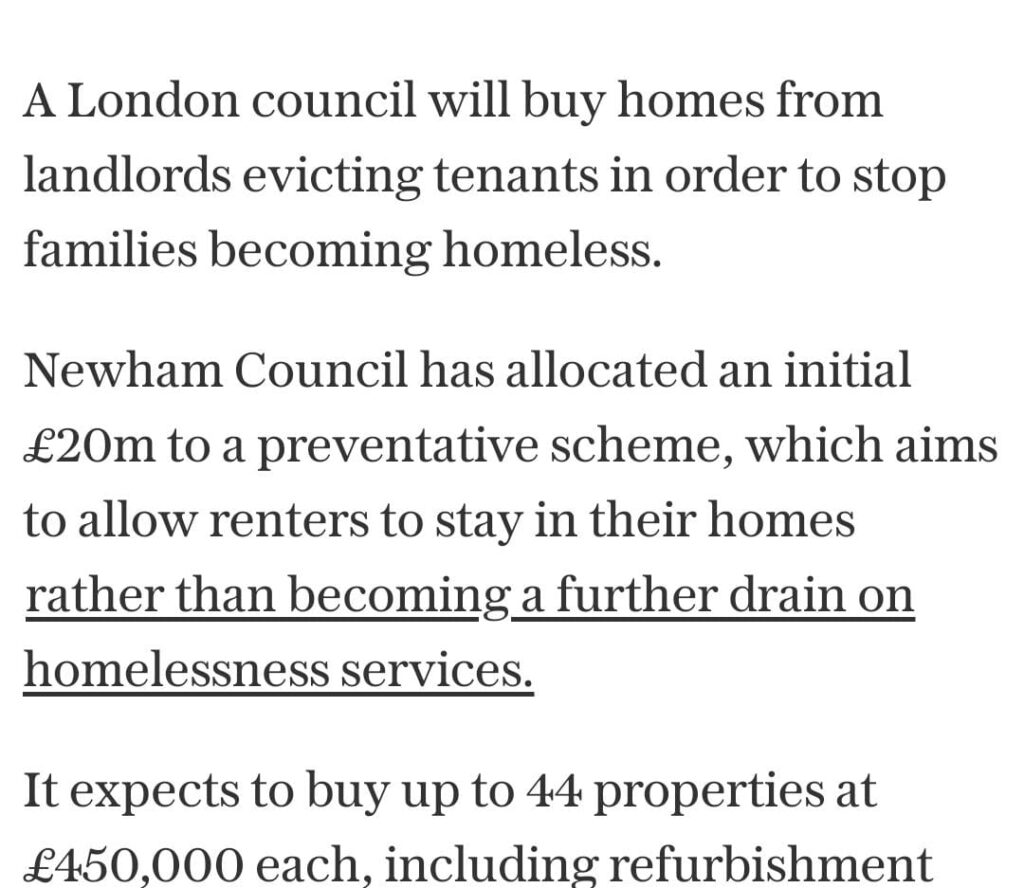

Due to the recent surge in inflation, the Bank of England has opted to raise interest rates, subsequently triggering a housing market crisis. As a consequence of this development, numerous buy-to-let landlords have found themselves compelled to list their properties for sale on the market.

Meanwhile, in the neighbouring borough of Newham, financial officers, in close collaboration with legal and housing colleagues, have discerned a promising opportunity. They’ve taken note of the widening gap in borrowing costs between what is being offered to buy-to-let landlords and what the council can access. This has unveiled an economically efficient method for the council to acquire these properties currently on the market.

In contrast to buy-to-let landlords who can solely secure loans from commercial lenders, Newham Council has the distinct advantage of borrowing directly from the UK Government, facilitated through the Public Works Loan Board, at significantly more favourable rates. Subsequently, the council can proceed to lease these properties to homeless families at affordable rental rates, while also benefiting from grant funding from the Greater London Authority, amounting to £60,000 per unit.

This strategic move enables Newham Council to augment its housing inventory with external financing, without tapping into the council’s reserves or Housing Revenue Account.

Can Tower Hamlets Council do the same here? Off-the-shelf purchases rather than building the houses?

In the summer of 2022, I penned an article foreseeing challenges for Mayor Rahman in fulfilling his pledge to construct 4,000 homes due to a deteriorating economic outlook. Unfortunately, these predictions have materialised due to the worsening economic conditions. However, it is worth noting that, as Newham Council demonstrated, Mayor Rahman can acquire these homes at heavily discounted prices through a credit card provided by His Majesty’s Treasury. This approach offers the advantage of obtaining ready-made homes without enduring the traditional 4 to 5-year wait associated with a conventional house-building program.

We anxiously await further developments in this matter…

Recent Comments