As outlined in a previous article, the way Council Tax operates in Tower Hamlets is that it is regressive meaning poor people pay more as a proportion of their income than those richer. That it has been over three decades since the last rebanding of properties, that a rebanding of properties will be part of the solution of the problem of higher rate payers paying proportionally less as we haven’t had a rebanding to take in to account massive increases in property prices. Therefore local authorities which have seen huge property price inflation, and therefore ensuring housing crisis issues, have not received any increase in revenue to deal with the fall out.

Statutory Powers of Local Councils – Tailor Made Local Council Tax Reduction Scheme (CTRS)

But local Councils potentially have the power to change that. Section 10 of the Local Government Finance Act 2012 added a new power enabling councils to reduce a person’s liability to pay in accordance with the authority’s Council Tax Reduction Scheme. This states that liability may be reduced “to such an extent as the billing authority thinks fit.This Section 10 power also enables councils to create categories to which reductions in council tax can apply.

A Local Redistributive Budget Policy – A local transfer from the Rich to the Poor

Consequently, Tower Hamlets Council could decide to introduce a progressive differential council tax that would enable them to effectively freeze council tax for people living in modest accommodation. But the quid pro quo would be to levy a sufficient council tax increase on more affluent households living in larger accommodation. This would allow councils to raise enough resources locally to not only stop further cuts, but to start investing in local services again. Anyone on a restricted income living in higher council tax banded accommodation would be protected by a council tax support scheme.

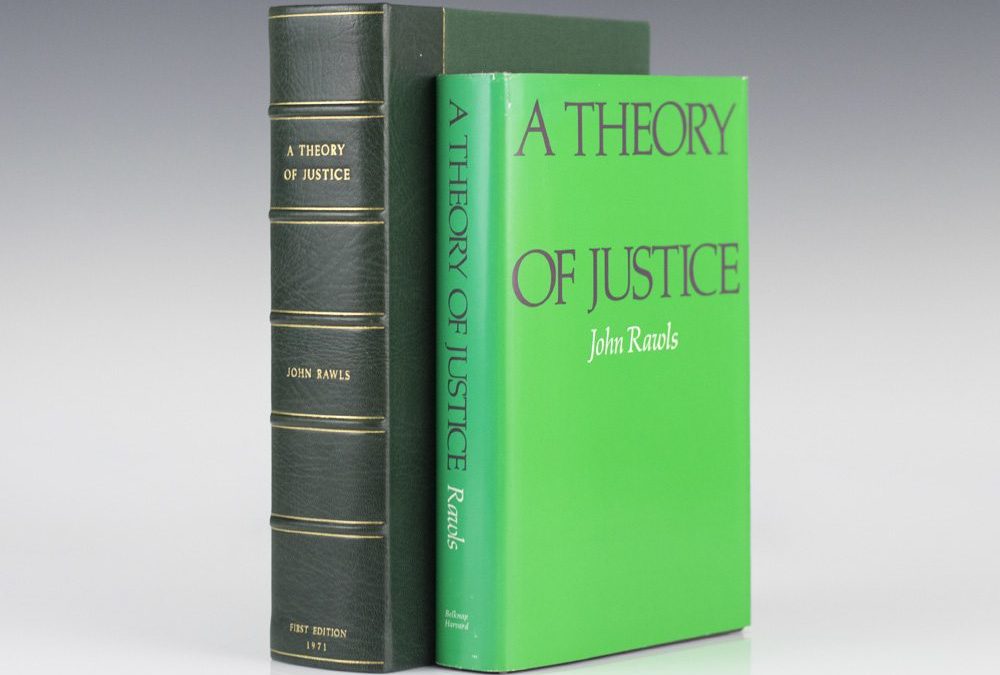

How do you get a society that provides basic decent services to all citizens? Political theorist John Rawls had a good idea, and it was called ‘the veil of ignorance.

Testing the Argument and Policy – Let the People Decide

The Localism Act 2011 would require councils taking up this suggestion to put the proposition to a referendum, because the council tax increase would be well above the 5 per cent threshold. But those living in lower council tax banded properties would have the increase progressively discounted down to zero. Meanwhile, those in higher council tax banded properties would pay a progressively higher increase.

“The natural distribution is neither just nor unjust; nor is it unjust that persons are born into society at some particular position. These are simply natural facts. What is just and unjust is the way that institutions deal with these facts.”

John Rawls (1921 – 2002)

Recent Comments