The normal argument of increasing taxes to enhance public spending is an argument we are all familiar with. However the arguments with increasing Council Tax to save public services is not as clear cut as it seems.

Council Tax – The New Poll Tax

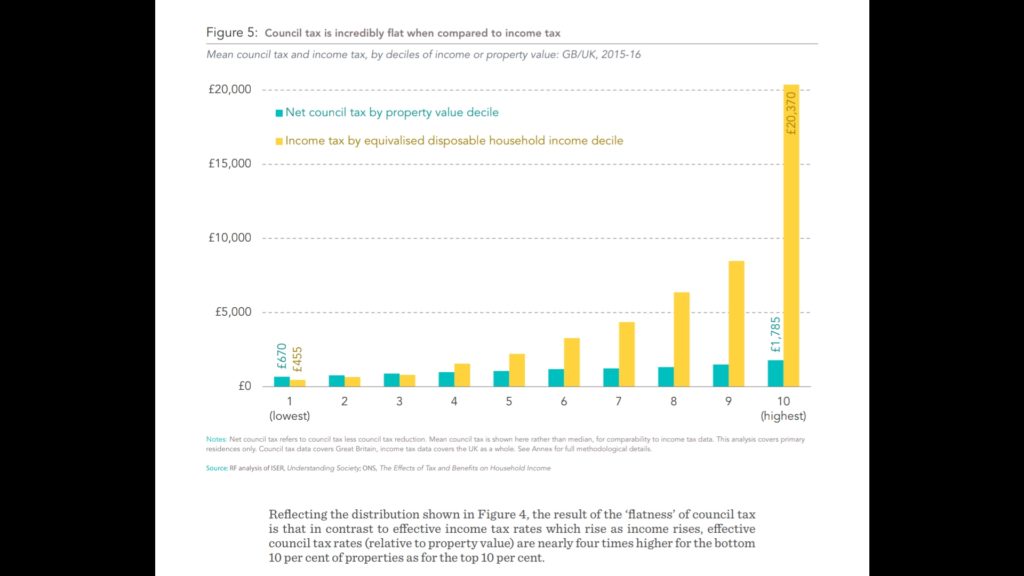

Council Tax is a highly regressive tax, in the sense that the poorer you are the more you pay in proportion to your income. Council Tax shares the a lot of the same features as a modern day poll tax. This is because council tax operates within wide bands with a single band covering significantly different property values; has only very small gaps between bands compared to differences in property values; and because regional variation has allowed some areas with more expensive properties to charge lower tax rates.

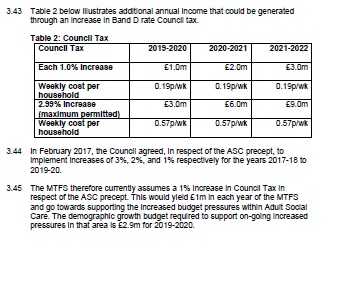

A. Wide bands: Among band A homes in the North East the lowest-value tenth of properties were worth £65,000 or less in 2015-16 while the highest-value tenth of properties were worth at least £130,000. Given they face the same tax bill, this results in effective council tax rates (tax as a proportion of property value) at least twice as high at the bottom of the band as at the top.

B. Small gaps between bands: Typical council tax bills are only 3.3 times higher for the most expensive homes in band H as for the cheapest in band A (£2,595 and £775 respectively). By contrast, typical property values were nearly seven times as high (£750,000 and £110,000 respectively).

C. Local variation on rates and severely out-of-date valuations: Local areas with high-value properties can opt to charge low council tax rates, causing vast regional disparity. Coupled with faster house price growth in the South of England than elsewhere since properties were last valued 27 years ago, this means that the typical effective tax rate was around three times as high in the North East as in London (0.7 per cent and 0.2 per cent respectively).

For example, someone living in a property worth £100,000 pays around five times as much council tax relative to property value as someone living in a property worth £1 million.

Young Families Hit Hard

A report from the Resolution Foundation, shows that young families are being disproportionately and increasingly hit by these major flaws. 85 per cent of households in their 20s live in the bottom three council tax bands (which have the highest effective tax rates) up from 79 per cent two decades earlier. As a result, the typical council tax rate as a proportion of property value is 0.54 per cent for those aged 30-49 compared to 0.43 per cent for those aged 80 and over. Flaws in the design of council tax also particularly harm younger households facing high barriers of entry into home ownership. For example, second homes and empty properties are, on the whole, still subsidised, while house prices have been pushed up by the fact that property is under-taxed relative to other investments.

Double Austerity in Tower Hamlets – Poorest hit hard – extra pressures on public services

In light of the above and available data, poor families will be hit harder with any council tax rises, this will not have a neutral effect on public services, in fact it will add pressures on them. As austerity policies have not worked on a national level, why do we think they will work at a local level in Tower Hamlets.

Austerity is a political-economic term referring to policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. In normal circumstances, tax increases can reduce consumption by cutting household disposable income, but tend to have a neutral effect on public services, in the case of Council Tax, hitting the poorest harder, this inevitably results in an increase in the demand on public services. Thereby potentially offsetting any gains made in revenue.

Asking the Right Questions

Therefore in light of the aboove, given the extreme levels of poverty and inequality in Tower Hamlets, given the cut-backs in public services, given the increase in demand on those services due to rising poverty and inequality, given that a rise in Council Tax disproportionately affects the poorest, is the correct question to ask:

Should we raise council Tax to save public services? Or should we be asking other questions?

The wise man does not give the right answers, but poses the right questions. – Claude Levi Strauss

Recent Comments